One way the Federal Reserve has encouraged lower mortgage interest rates is by following a policy of almost unlimited buying in the mortgage-backed securities market. The Federal Reserve has bought $1 trillion of mortgage bonds since March.

The Federal Reserve also sets a benchmark interest rate. The national interest rate is hovering around zero, and it’s likely to stay that way through most of 2021. Mortgage rates are higher than the national interest rate, but they are directly influenced by it.

Another factor in the current low interest rates is the instability of the stock market. Investors who are hesitant to put their money in the stock market look for other places to invest, including mortgage-backed securities. This drives the rates down.

Most analysts expect mortgage rates to stay low for some time. COVID-19 is not going away quickly. Even if a vaccine came out tomorrow, it will take time for the economy to recover. Progress is not likely to be in a straight line; in fact, Europe is seeing upticks in new cases and is considering more lockdowns. With so much uncertainty, the Federal Reserve is unlikely to make any moves to raise interest rates soon.

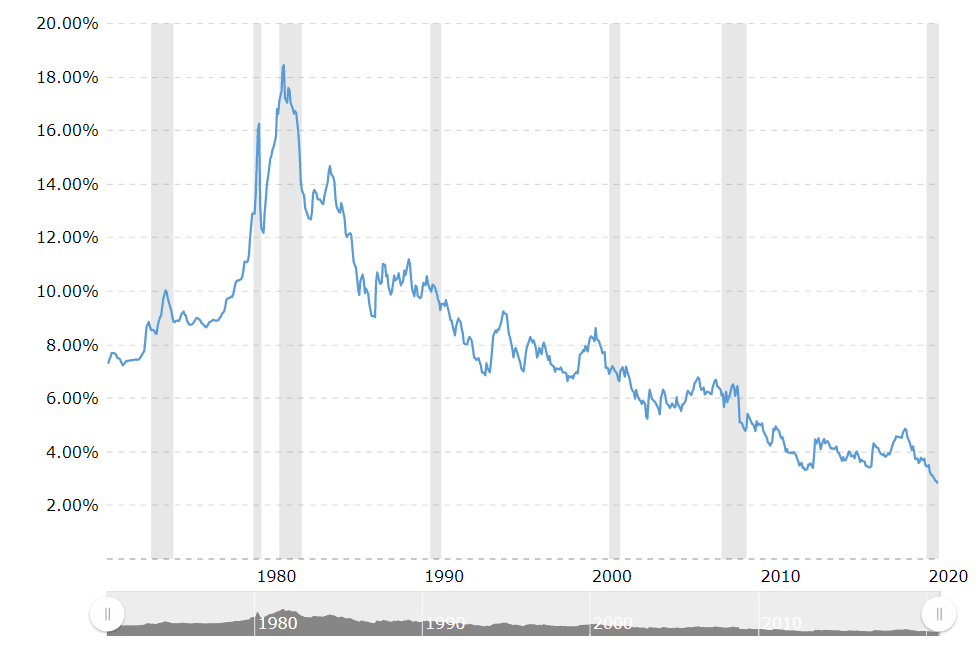

In the graph below you can see average interest rates on 30-year fixed rate mortgages in the United States for the past 50 years. As you can see, 2020 marks the most significant downward trend in recent memory.

At the same time interest rates have hit record lows, home values continue to skyrocket. By July this year, home values were up an average of 5.5% compared to 2019. That makes refinancing even easier for homeowners, because when their home values go up, their equity as a percentage of their home values also increases.

Today’s Refinance Rates

Refinancing savings: the numbers speak for themselves

Refinancing to take advantage of even a small difference in your mortgage rate can save you money. The average mortgage rate on a 30-year fixed-rate mortgage has fallen by 0.97% since October 31, 2019, from 3.78% to 2.81%. That might not sound like much. But if you have a $200,000 mortgage, that difference can mean a savings of approximately $107 per month on your mortgage. Over the life of a 30-year loan, you could save $38,443.

If your current mortgage is 4.5%—a common rate just two years ago—the difference is even more dramatic. Refinancing to a 2.81% rate could save you $190 per month on a $200,000 loan, or $68,586 total over the life of a 30-year loan. Your actual savings will vary depending on the length of time left on your original loan.

You can get market-beating rates by choosing the right lender

Even when rates are historically low, you need to make sure you find the right rate for you when you buy or refinance a home. Lending companies, such as Quicken Loans, AmeriSave and offer significantly different interest rates based on borrower qualifications, type of loan, and other factors.

| Lender | Minimum Credit Score |

|---|---|

| 620 | |

| 620 | |

| 620 |

How do I get started?

The first thing you should do is start comparing lenders. By exploring top online mortgage providers you can ensure you’re getting a good deal. Make sure you’re capitalizing on money savings tips. For example, many lenders offer lower interest rates for shorter-term mortgage loans. For example, the average interest rate on a 15-year loan is 2.32%, compared to the average rate of 2.81% on a 30-year loan. Your mortgage payment will be higher on a 15-year loan because you pay more toward the principal amount every month. However, if you can afford the payments, you’ll save on total interest expense and pay off your house in half the time.

Is refinancing worth the hassle?

If mortgage rates have dropped by 0.75% or more since you purchased or last refinanced your home, you have a good credit score and 20% or more equity in your home, and you plan to stay in your home for several years at least, you generally save money by refinancing your home.

Be wary of refinancing your home if you won’t live there long enough to recoup the costs of refinancing. And try to avoid increasing the amount of your loan every time you refinance.

Should you refinance with an adjustable rate mortgage?

Another way borrowers try to get a lower mortgage rate is by refinancing with adjustable-rate mortgages (ARMs). Rates on ARMs are usually lower than on fixed-rate loans because lenders can raise rates at the end of the initial period if interest rates rise.

In the current market, however, rates on ARMs are actually higher than on fixed-rate mortgages, averaging 2.88%, vs. fixed-rate mortgages at 2.81%. That makes fixed-rate mortgages potentially a better deal now.

Our Recommended Lenders

AmeriSave Mortgage

AmeriSave Mortgage Corporation is a full-service mortgage lender operating in 49 states and DC. Established in Atlanta in 2002, it has funded 220,000+ homes for a total value of more than $55 billion. AmeriSave is known for offering streamlined online applications with the option of contacting customer support any time you need assistance.

- Apply and submit forms directly online

- No SSN needed to get pre-approved rates

- Recommended for refinancing

![]() AmeriSave MortgageView Rates

AmeriSave MortgageView Rates

Quicken Loans

Quicken Loans is one of the most reputable mortgage lenders. It offers a large range of mortgage options including refinance loans, FHA, USDA, VA loans, jumbo loans and more.

- Fast application process

- A bevy of educational resources

- Award winning customer service

Quicken LoansView Rates

LoanDepot

offers homebuyers a portal to compare mortgage loan offers. You can access basic mortgage information without signing up for an account, and it’s easy to update your information and view additional loan offers in a simple and straightforward manner.

- Various fixed and variable rate options

- Refinance and purchase loans available

- Find info without signing up

.20220323115544.svg)